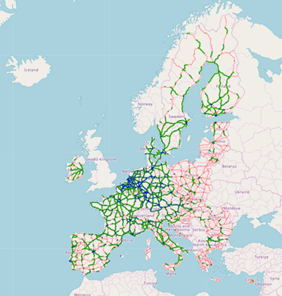

The number of electric vehicles (EV) on our roads has steadily increased over the last few years and continues to trend upwards. This fast-growing market and the trend towards full electrification is strongly influenced by current political and societal issues and challenges such as climate change and the concern with living more sustainably. With the increased number of e-mobility enthusiasts also arises the need for a comprehensive and reliable network of EV-chargers (EVSE). However, according to a survey by the European Commission, there are still large gaps in the availability of fast-charging (upwards of 150 kW charging power) EVSE across Europe, particularly in the Eastern countries as well as in more rural regions throughout the EU.

Fig. 1: Gaps in the EU fast-charging network. Source: European Commission (https://ec.europa.eu/transport/infrastructure/tentec/tentec-portal/map/maps.html?layer=11,12,13,14,15)

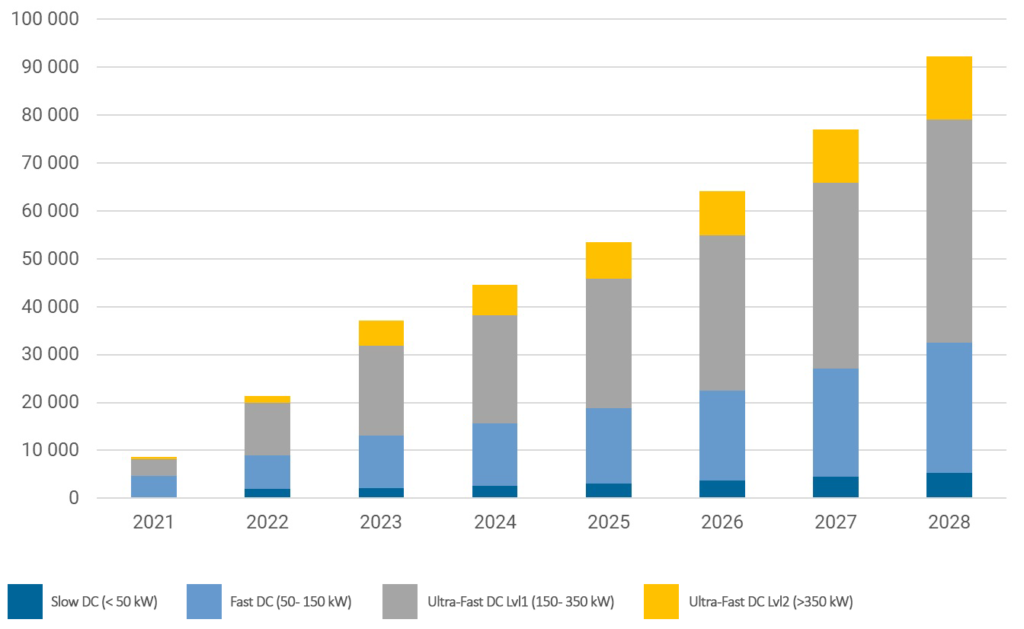

While the European Commission prognoses a clear trend towards ultra-fast DC chargers with charging powers upwards of 150 kW for any new-built charge points, with over 90 000 total charge points estimated throughout the EU in 2028, supplying this market is not without challenges for manufacturers as well as operators of EVSE. For operators, the biggest challenge is providing stable and functional public charging infrastructure with minimal downtime for e-motorists. Most importantly, this requires a stable internet connection. A thing which is still not a given in some areas, even, and perhaps surprisingly, throughout an otherwise technologically leading country such as Germany. Further, a comprehensive service and support concept should be employed to ensure that chargers are kept operational and that any customer issues at the charge points are dealt with swiftly. Additionally, there is a push towards the use of clean, renewable energy sources for supplying public EVSE, which is not least reflected in the fact that this is a prerequisite for many funding programs.

Fig.2: Expansion of DC Charge Points in EU 2021-2028. Source: European Commission

For manufacturers, the push towards faster charging is currently among the main concerns. The market demands shorter charging times, similar to the time it would take to refuel a car at a petrol station. While this is feasible for most newer-generation electric vehicles through cooled HPC cables and charging powers of around 500kW, energizing the logistics and transport sectors necessitates still more research into Megawatt Charging (MCS). Though there are some first solutions already available, these are mostly still on a trial basis and have not reached the global mass market yet.

In addition, the EV charging market is also subject to a large number of regulations. Prominently, the Alternative Fuels Infrastructure Regulation (AFIR), which is part of the European Union’s Green Deal, has taken effect in mid-April. The aim of this regulation was to enable wide accessibility of public charging infrastructure and the possibility to charge without the need for a roaming card, which would in turn necessitate a prior contract with a roaming provider. Therefore, among other things, AFIR prescribes the possibility of paying for the charge via debit or credit card, a means of payment already used by a large percentage of the population. This is, however, by no means a new solution, but was already pioneered by the Austrian EVSE manufacturer EnerCharge in 2018.

An innovative approach to compliance with restrictive regulations

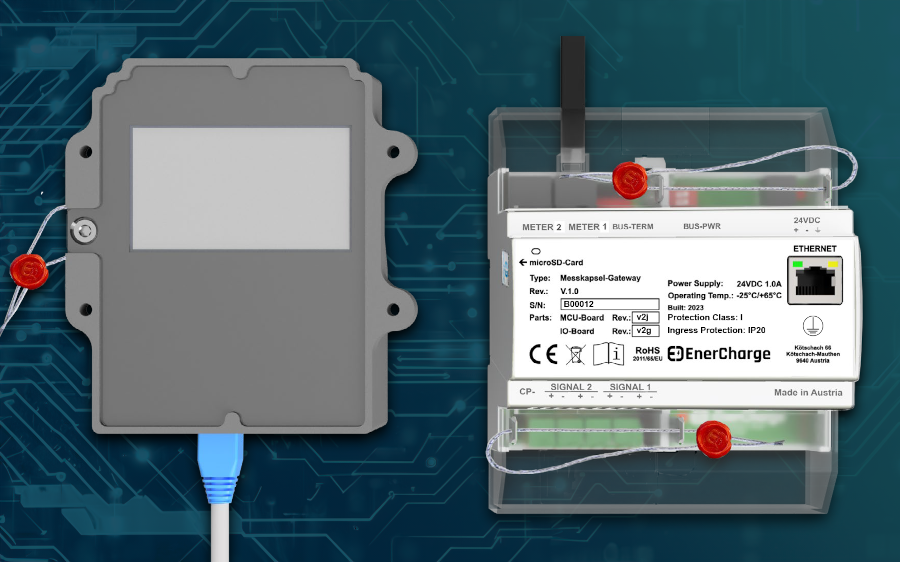

Further, the regulations captured in the German Weights and Measures Ordinance and the German Weights and Measures Act (MessEG/MessEV) are currently some of the most impactful for European manufacturers or manufacturers looking to serve the large German, and prospectively the entire European, EVSE market, as they prescribe a framework for legally compliant metering and billing for the growing network of largely commercially used DC EV-chargers in Europe.

In Germany, no new charging stations may be commercially installed which do not comply with the calibration requirements of the MessEG and MessEV. The BEÖ, as the association of Austrian electric mobility providers, and corresponding bodies in other European countries are also actively pursuing this direction in various position papers. A charging station that complies with calibration law must thus have a type examination certificate from a conformity assessment body. Ensuring that billing complies with calibration law and, above all, is transparent has therefore also been a major research and development topic for the Austrian manufacturer of charging infrastructure EnerCharge in recent years. “It is clear that consumer protection must have top priority in all such considerations and specifications. Tamper-proof hardware and software, with the possibility of on-site recording of secure metering data, must be guaranteed without exception,” says CEO Dr. Jens Winkler. “These framework conditions led to EnerCharge developing a universally applicable metering capsule.”

The application of the new metering capsule represents a completely new way of communicating between the charging infrastructure and the vehicle as far as energy measurement is concerned. By measuring energy using the CP signal, direct contact is established with the vehicle as soon as it is plugged in and a transaction ID is opened. The amount of energy supplied is indicated by an energy meter within the metering capsule that complies with the German Weights and Measures Act. This results in the advantage of direct, fast communication with the vehicle and accurate billing.

This solution can be used in both AC and DC systems and has resulted in a standardized overall solution for greater flexibility, with a smaller component size and less dependence on individual meter manufacturers. Another key advantage of the new, decoupled system is that, for example, information on new vehicles, software updates (including closing security gaps), etc. can be imported without recalibrating the entire system, as the calibrated part of the system remains unchanged.

Due to the restrictions imposed by the described regulations, legally-compliant billing is mainly focused on tariffs billing charging customers for the amount of energy used. The approach taken by the EnerCharge Metering Capsule, however, also allows for the billing of time, i.e. the prescription of a parking or blocking fee. This creates interesting new tariff models for operators, as imposing such fees effects a higher customer turnover rate at the charger by reducing idle time, which in turn secures higher availability of the charging infrastructure.

A further step towards higher convenience for operators and charging customers is the integration of dynamic pricing by interfacing with the electricity market. Instead of a fixed rate per kWh charged, a flexible rate more closely follows the operator’s actual energy cost, significantly decreasing the pricing risk for the operator and making for more attractive tariffs for charging customers when energy prices sink below the otherwise fixed rates.